Method 1: Setup each client as a sub-liability account of Trust Liability

Even if you are an expert in QuickBooks Online, you may not know how to easily maintain a trust account for a law practice. If you are an attorney and have little experience with QuickBooks Online, you definitely don’t know. Don’t worry, once you get it setup up, it will be easy to see the balances and perform a three-way reconciliation.

Really, there are two main ways to easily keep track of every client’s balance in the IOLTA account. Each has it pros and cons but both are fairly easy once you get it figured out. This post is going to cover one method and next week, you will learn the next method. There is going to be a lot of pictures so you can see exactly what to do, but remember QuickBooks Online is constantly changing so probably as soon as this blog is live, some of the images may look different on your end.

Trust Account Liability Setup

The first thing you are going to need setup is the trust liability account. If you already have this setup, skip down to the next step.

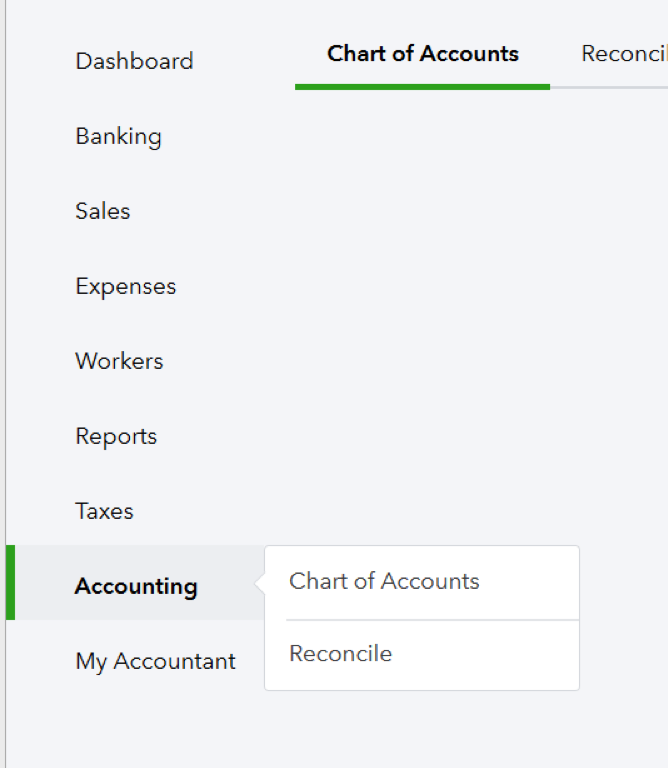

Hover over accounting on the left hand side and then click Chart of Accounts.

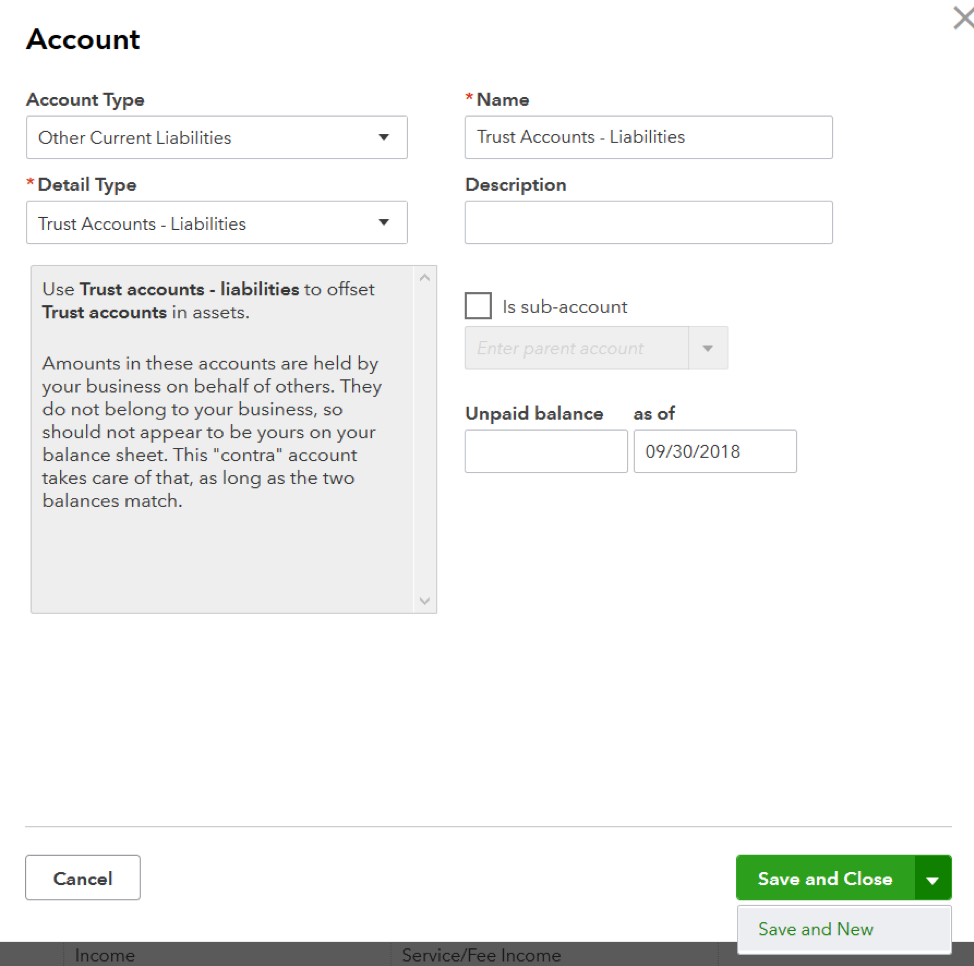

From here, click on the green “New” button near the top right side. When the Account box pops up, you will need to change a couple of things. Change the account type to Other Current Liabilities, change the Detail Type to Trust Account – Liabilities, and the name will change to Trust Account – Liabilities. You can change the name if you want.

Now, click save and new.

Yay! Now that we have this piece done, we can setup sub-accounts.

Sub Liability Accounts Setup

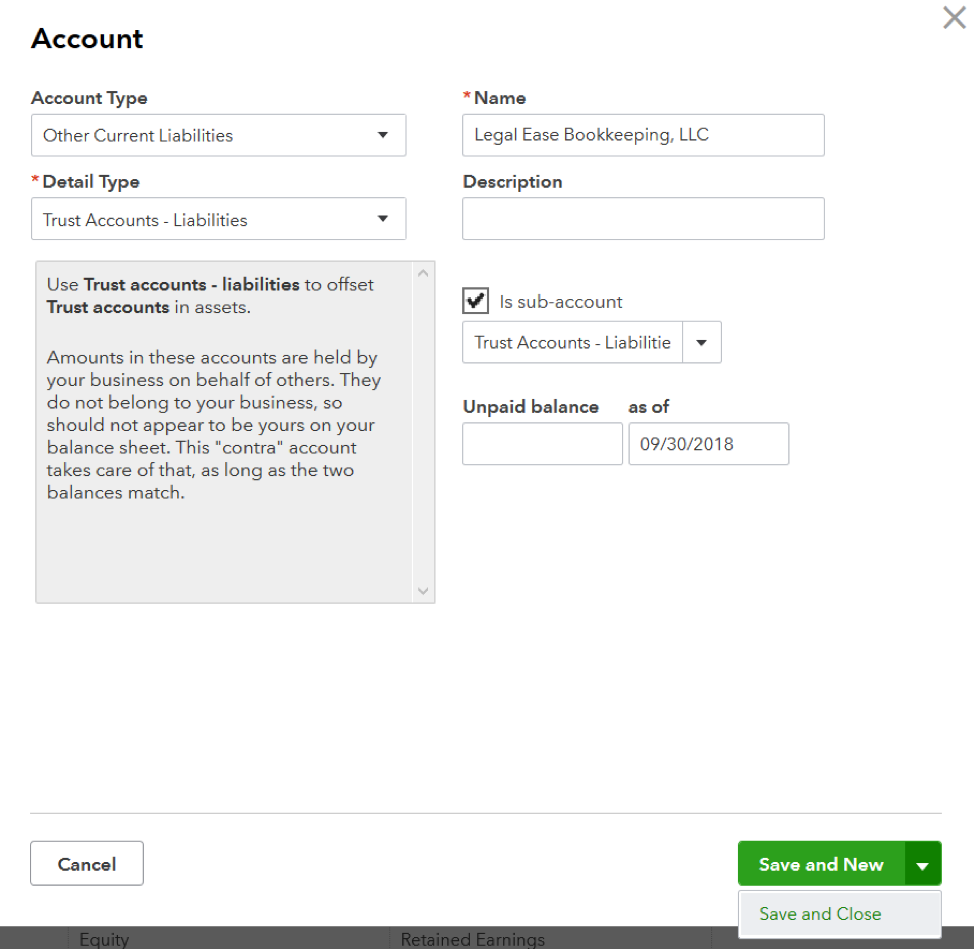

Now that you have the trust account liability setup, we can setup sub-accounts. Change the account type to Other Current Liabilities, change the detail type to Trust Account – Liabilities, change the name to be the client’s name, check the box next to Is sub-account, and select Trust Accounts-Liabilities.

Click save and close.

Woot woot! Now you have a sub-account made!!!

As you enter transactions in the trust account in QuickBooks Online, make sure to select the appropriate client.

Where to see the balances

So you have entered transactions, now how do you see them?

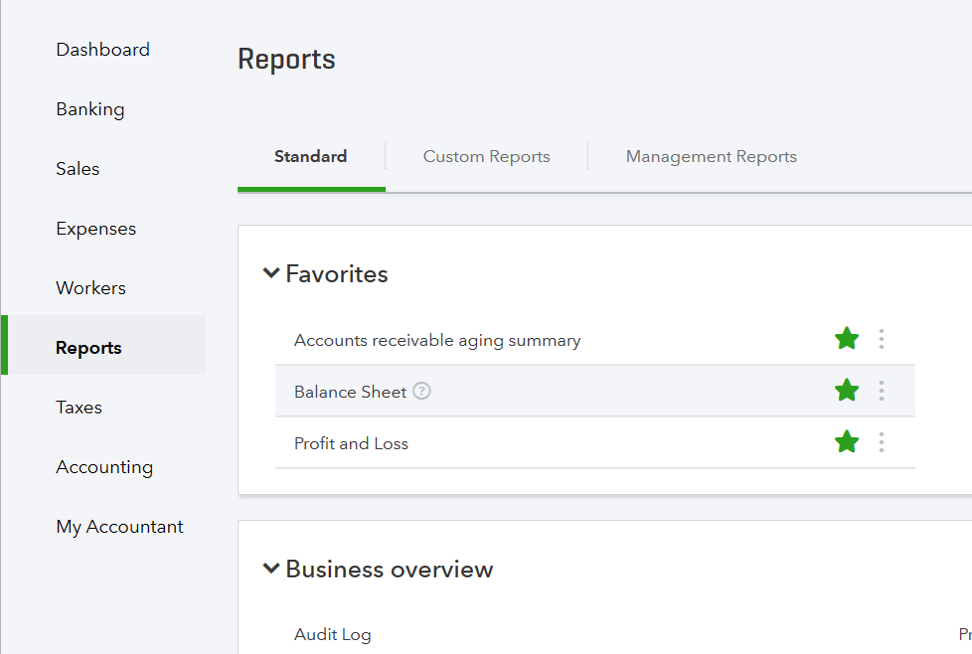

Click on reports on the left hand side and select the balance sheet.

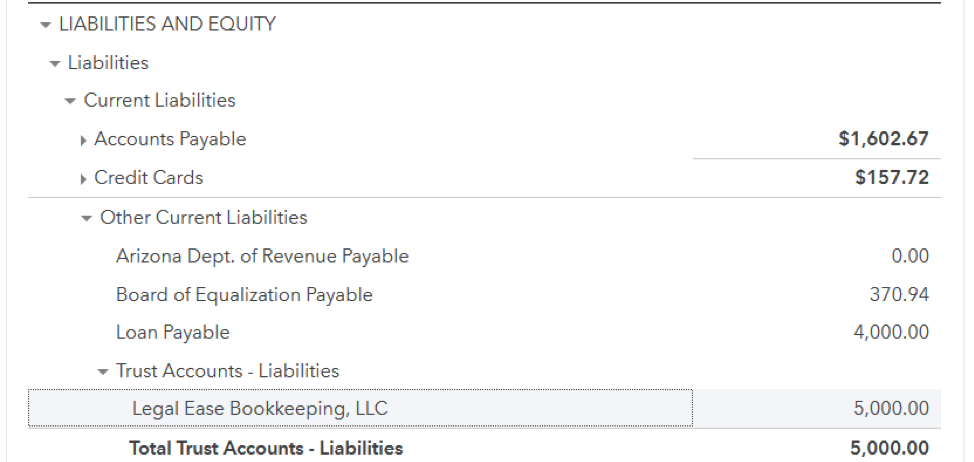

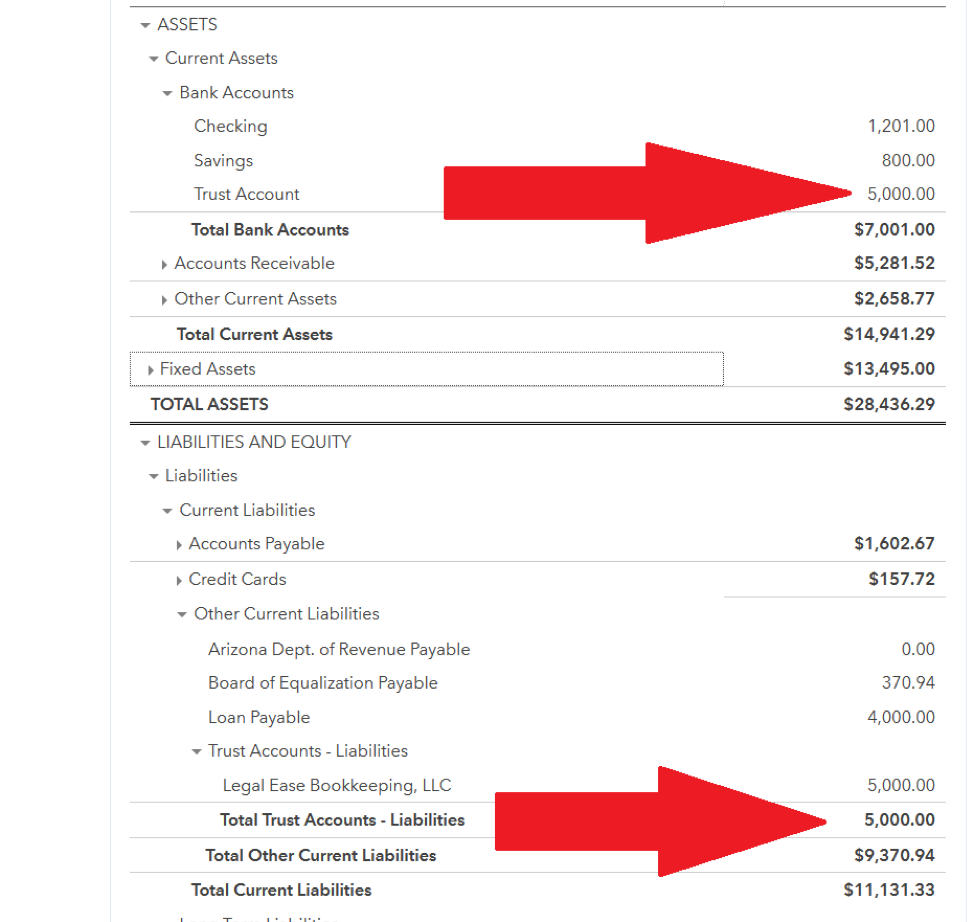

If you scroll down until you get to liabilities, then under Trust Account – Liabilities, you will see all the balances you for each client. Yay!

****One important reminder is that your trust bank balance should always equal the amount in trust account – liabilities.

Pros

So like I said, there are two methods. Each one has benefits and some issues. The biggest pro to this method is that it is super simple. Also, it is easy to implement and the information is easily available to fill out three-way reconciliation forms. It is also fairly easy to figure out where the problem is if the bank balance and the liability balance don’t match.

Cons

There are a couple of drawbacks to this method. The first is that if you have a ton of clients this will make your balance sheet ridiculously long. The other problem is if you use QuickBooks Online to invoice for trust account activities, it means you have to setup a product/service for every client as well. Again that is really only a pain if you have a ton of clients.

The second method will be posted next week and will overcome these cons but it is a little more complicated. Hopefully, this makes keeping track of your IOLTA balances easier!