I recently had an attorney who came to me because they thought their client’s trust balance in QuickBooks Online was off. In order to check the balance, you have to do multiple things:

1. Make sure the trust transactions are accurate by reconciling the bank account

2. Make sure the trust bank balance matches the liability balance in QuickBooks

3. Make sure the trust ledger in QuickBooks looks accurate

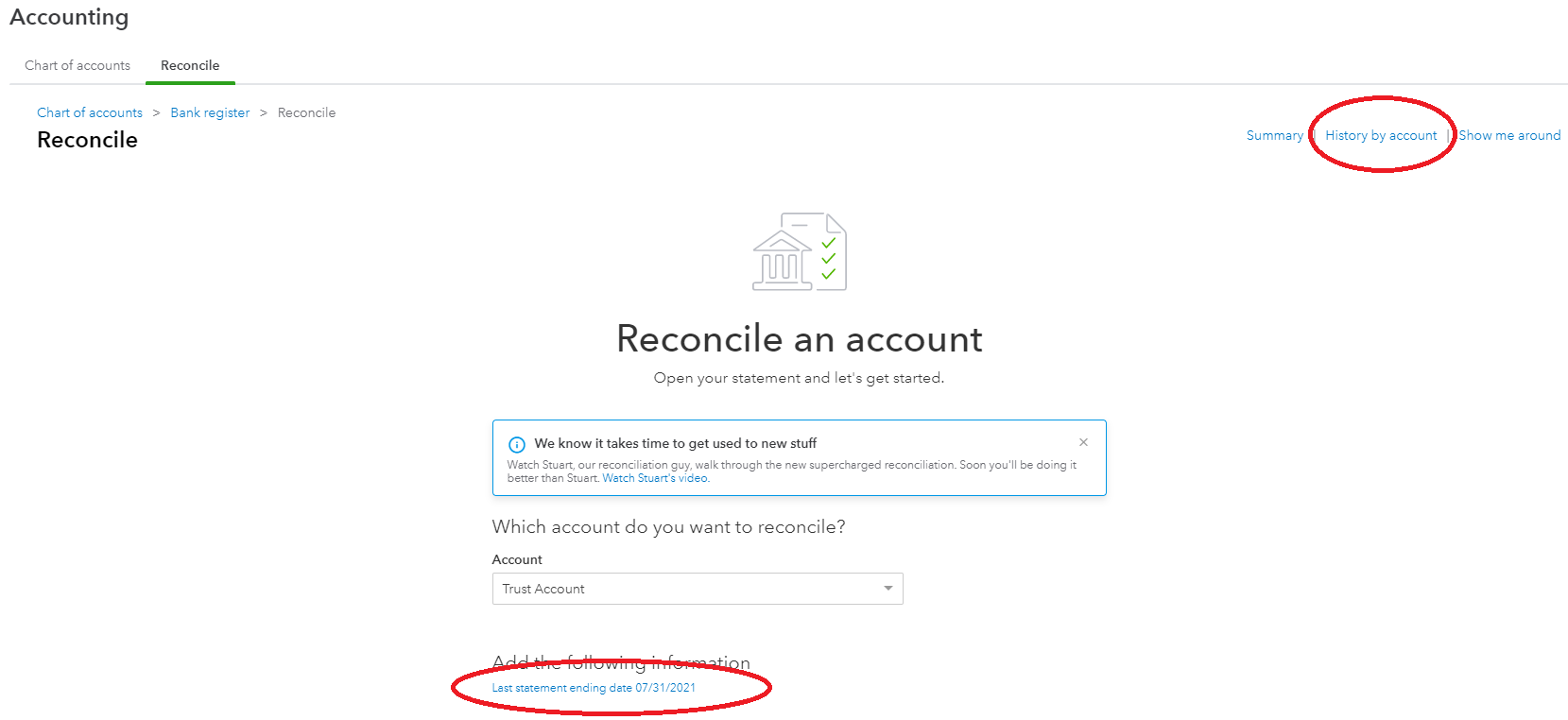

The first thing I did was go to the reconcile screen in QuickBooks. Then, I checked to see when the last time the account was reconciled. It was reconciled as of the end of last month, which was 7/31/21, so that was a good sign. If it hadn’t been, I would have wanted to reconcile it. After that, I looked at the reconciliation history and looked at the last reconciliation. You want to check the uncleared transactions to make sure they are valid. Luckily, this client didn’t have any uncleared transactions. Step one is not always this easy 😛

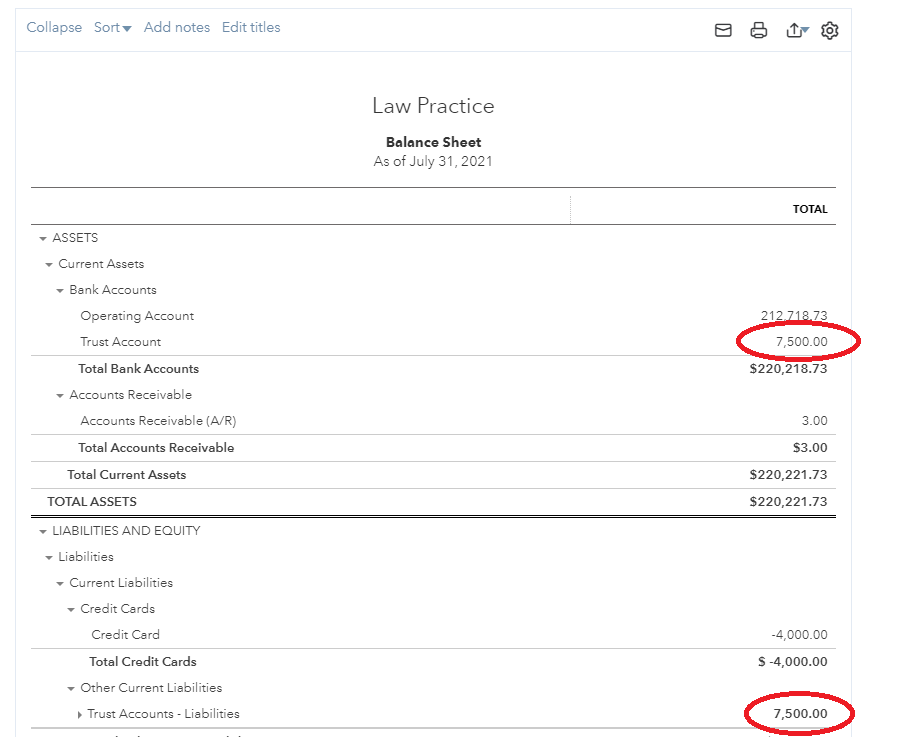

Moving on to the second step, I went to the balance sheet and compared the IOLTA bank balance and the IOLTA liability balance as of the last reconciliation. To my dismay, they didn’t match. In order to figure out the issue, I had to see when the last time the two numbers had matched. I usually start with the first of the current year. In this case, I looked at the balance sheet on 1/1/21. The bank and liability balances matched at that point. I changed the balance sheet date to be the end of January and then moved forward month by month until I found the first month where the balances didn’t match.

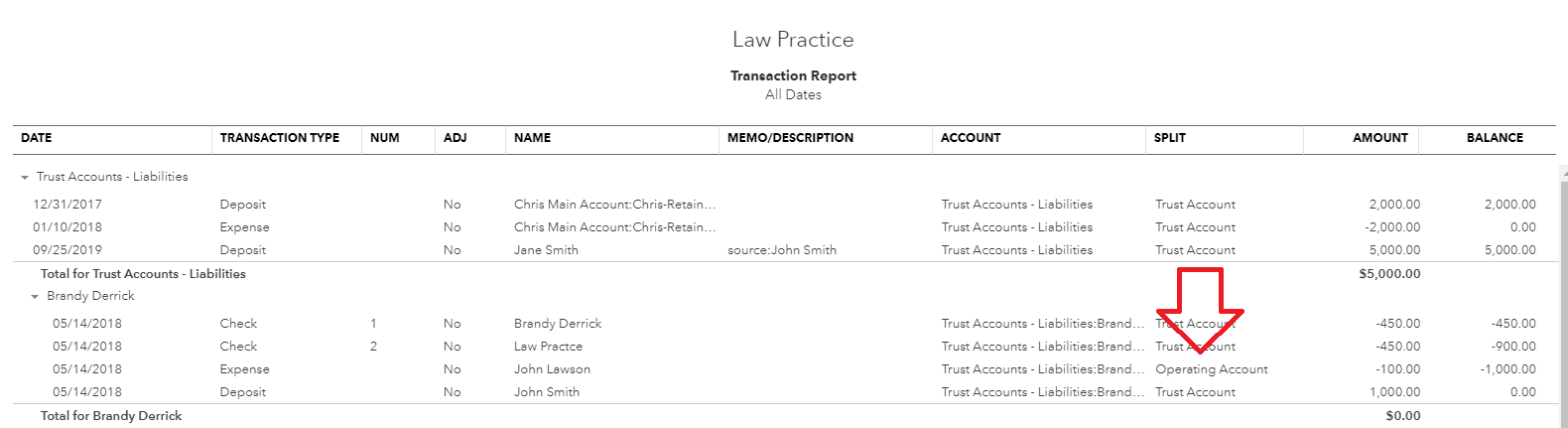

Depending on the volume of transactions, you may not want to look at a whole month all at once, but this client had only about 50 transactions for the month so I thought it would be fine to look at the whole month. When I looked at the liability transactions for the month and looked down the split column, I found there were transactions that were in the operating account but they were recorded against the client’s trust balance. The attorney had written checks to vendors, like translation services, from the operating account but recorded them as if they were reducing the trust balance. Transactions should only reduce the trust balance when a check or transfer is made from the IOLTA account.

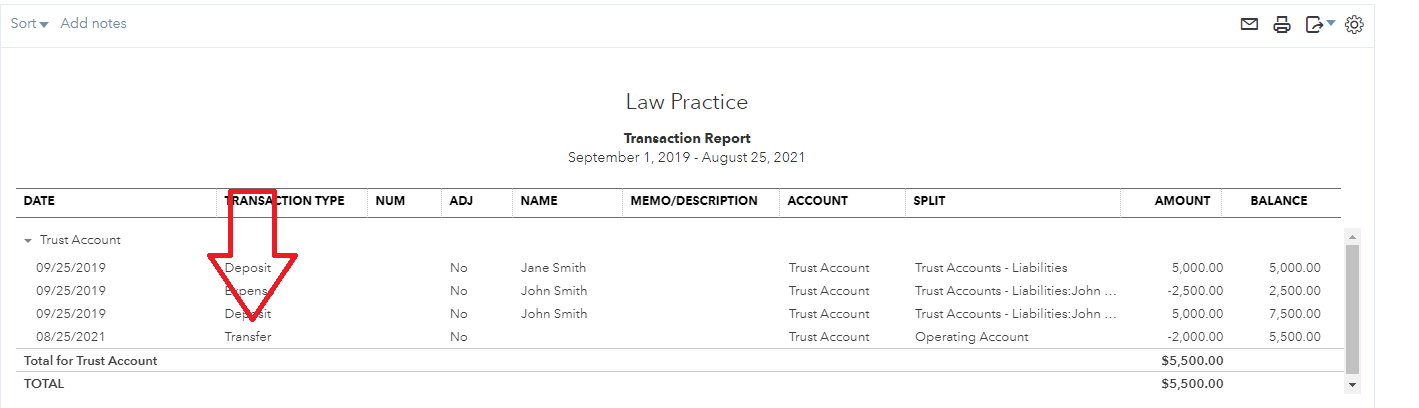

Once I got those all cleaned up the liability balance still didn’t match the bank balance, so I took a look at the IOLTA bank transactions in the same month. I noticed there were transfers made within QuickBooks from the trust to the operating. This is an issue because when you make transfers you cannot add a client name to them. These transfers had to be deleted even though they were already reconciled.

After deleting them and adding the expense in the trust account and the deposit in the operating account, I needed to fix the reconciliations otherwise the attorney would go to reconcile next time and there would be a beginning balance error. I strongly suggest fixing reconciliations by undoing them and redoing them as opposed to going into the register and manually reconciling them. I would also suggest running the reconciliation report and saving that report before undoing the reconciliation.

After I got done reconciling, I went back to the balance sheet and now my bank balance matched my liability balance. Woohoo! Now, I was onto the final step. Making sure the trust ledger in QuickBooks looks accurate. If the client uses another legal software, I would have checked it against it but they didn’t so what I do is go down the list of each client with a balance and make sure no one is negative. I also check to make sure every transaction has a client name. Since everything looked good there, I was able to send the trust ledger over to the client, explain what I did and let them know that I changed the trust balances on multiple clients.

If I had access to the bank account, I could go one step further and check the deposits and checks at the bank level and make sure the names matched the names in QuickBooks. With the checks that I performed, the attorney would know that unless there is something assigned to the wrong client, these are the correct balances.

If you are worried about your trust balances and think you might have errors, I would be happy to set up a free consultation with you to see if my firm can help you. You can use this link to schedule a call https://legaleasebookkeeping.com/contact-us/